Right up until the thing is your account equilibrium is fully compensated off, it is best to help keep making payments so that you don't get strike with additional late service fees and fascination fees.

Who's this for? LightStream, the web lending arm of Truist Bank, delivers low-fascination loans with adaptable terms for individuals with good credit rating or greater. LightStream is recognized for furnishing loans for just about every function apart from greater education and learning and compact enterprise.

NerdWallet’s assessment process evaluates and fees personalized loan merchandise from over 35 financial technological innovation providers and economic establishments. We gather about fifty details factors and cross-Test enterprise Web sites, earnings reports together with other general public paperwork to verify products details.

Who's this for? Citi enables existing deposit account holders to get their personalized resources as promptly as the exact same organization working day. Borrowers who haven't got a Citi deposit account can obtain their resources in up to two business enterprise days.

Regional and national credit history unions could offer lessen curiosity fees and a lot more adaptable terms than other lenders. You sometimes have to be a member to borrow from a credit rating union.

Citi® Own Mortgage proceeds cannot be accustomed to buy post-secondary education and learning fees or for company reasons. Credit cards issued by Citibank, N.A. or its affiliates, as well as Checking Plus and prepared Credit history accounts, usually are not qualified for financial debt consolidation, and Citibank will never challenge payoff checks for these accounts.

On-line lenders: On line lenders present you with a streamlined personal loan process and generally present the fastest funding moments. There are actually on the internet lenders that cater to borrowers over the credit score spectrum.

Upstart is a web based lending System specializing in individual and automobile refinance loans. In keeping with Upstart's Web site, 99% of authorized applicants obtain their funding in one organization day.

Should be used, have adequate earnings from another supply, or have an offer of work to begin throughout the upcoming 90 days.

Utmost APRs can be large. Should you have a small credit history rating, APRs on personal loans can be greater than credit card APRs.

APR: You will need to take into account the desire charges you might be made available given that the next price signifies You will be shelling out back a lot more money more than the bank loan's life time. get more info Acquiring the next credit rating usually qualifies you to get a lessen desire rate.

Bare minimum credit score score of a minimum of 300 (but will settle for applicants whose credit history heritage is so inadequate they do not have a credit score score)

Every single lender has its specifications. Typically, for the most effective possibility of approval, You will need a credit rating score of at least 660. To obtain the ideal costs and terms, you would possibly need a score of seven-hundred or increased. Assessment the person requirements for every lender you Examine.

For anyone who is unsure with the issuer within the account, be sure to check out for an index of Citi items and affiliate marketers.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Loni Anderson Then & Now!

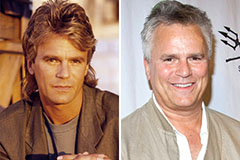

Loni Anderson Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!